Breaking through barriers in

Novel Energy & Planetary Health

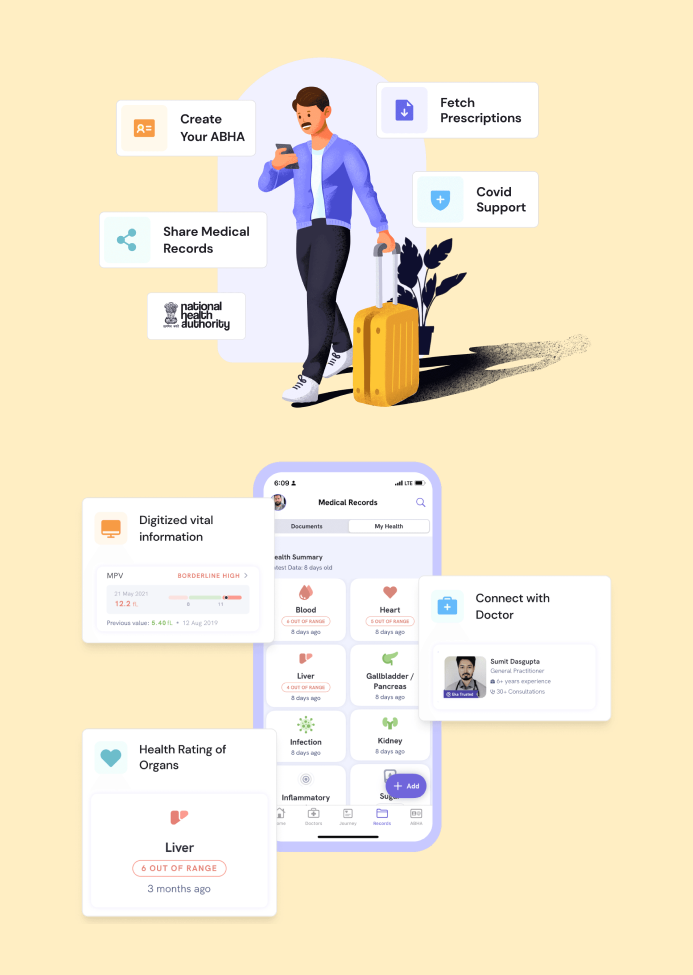

Human Longevity & Synthetic Biology

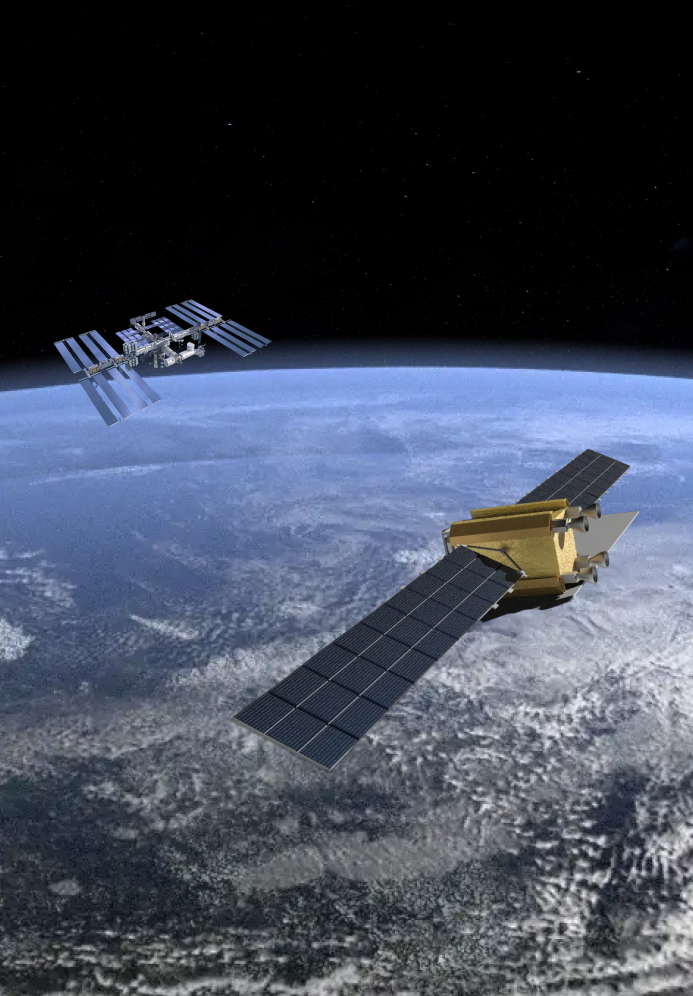

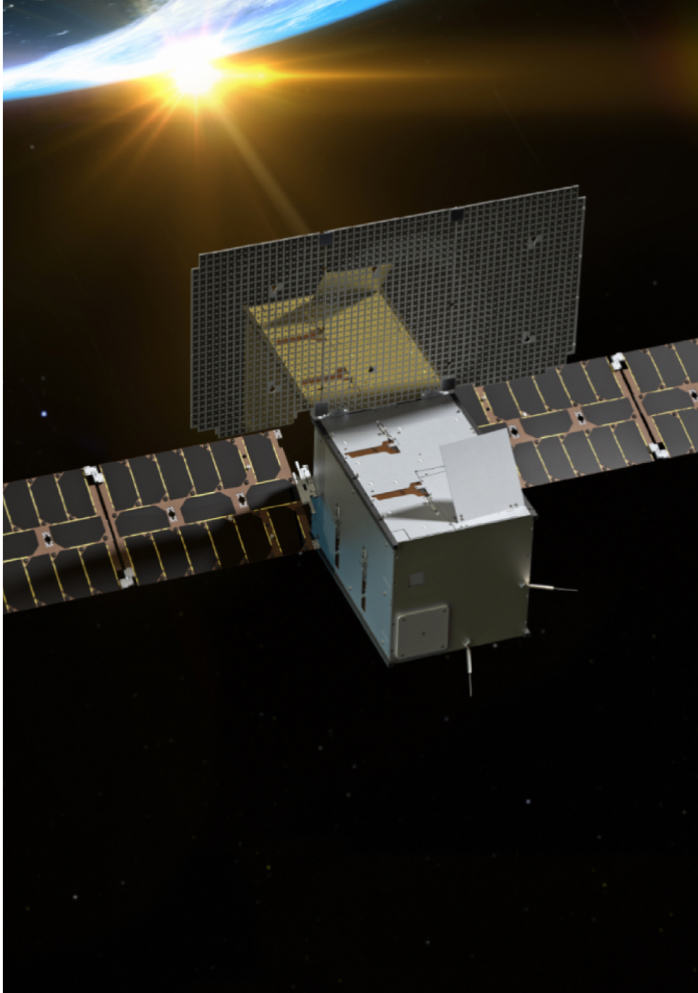

Beyond Earth & Space Tech

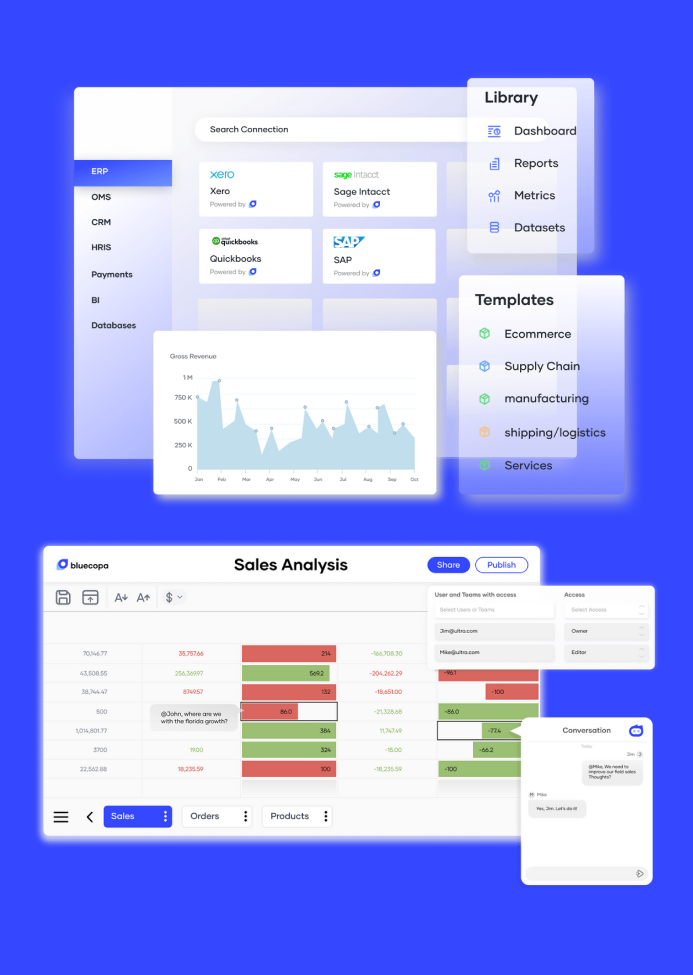

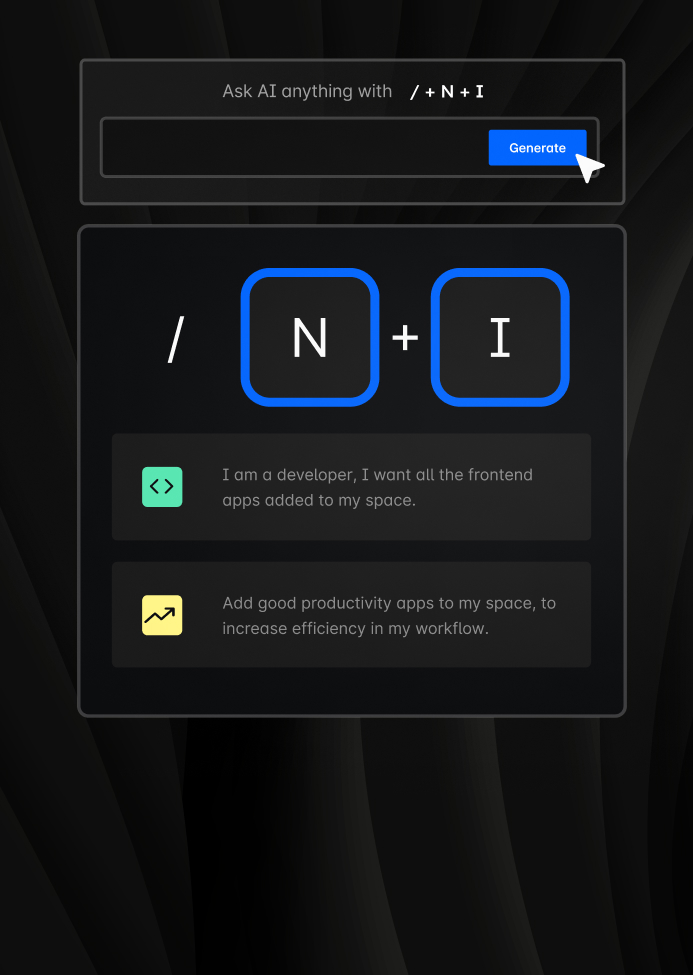

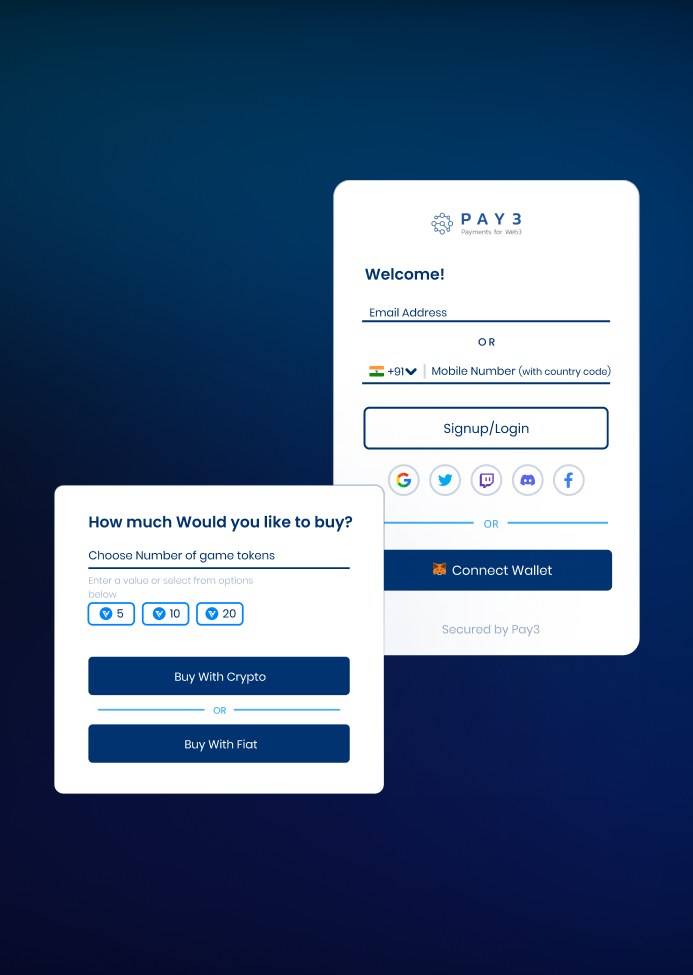

AI Led Software

Advanced Manufacturing

Focus

At Speciale Invest, we don't just fund startups, we build with them. From funding innovative ideas to providing strategic guidance, we help entrepreneurs scale effectively.

Early Stage Investment

We come in early with pre-seed and seed-stage investments.

Focus Sectors

We focus on deep tech innovations across DeepTech Hardware and Software.

Investment Size

Our sweet spot is ~$1M, with half of our total fund reserved for follow-on investments.

Thinking that Transforms

We backed these companies when they were still ideating and today, they are leading disruption in their industries. Our bets on the ideas of tomorrow include nuclear fusion, flying taxis, 3D printed rocket engines, AI & infrastructure, the future of health and many more.

Our Impact

9+ Years

$140+ Mn

45+ Companies

Founders' Voice

Vishesh and Arjun complement each other in knowledge, network, and perspective, while both consistently add value and support founders in achieving outsized impact. Always accessible and grounded, they offer clear, objective feedback and advice without intruding on the founders' core expertise. Their patient, detail-oriented approach helps them deeply understand the founders’ vision, allowing them to act as cohesive, high-impact partners.

Nikhil Ramaswamy

Co-Founder & CEO, CynLr

Founders' Voice

Right from our first conversation, the team at Speciale showed conviction in the problem we were solving. Vishesh and Arjun understand the founder journey and appreciate the spirit of experimentation. The Speciale Team — especially Dhanush— introduced us to other founders in the community who quickly came on board as angel investors. We are delighted that they're here to share the journey with us.

Saptashri Nath

Co-Founder & CEO, Airboxr

Founders' Voice

We met Speciale when Wingman was just three founders with no product or pitch deck. Since then, they’ve been true partners—helping us land early customers, connecting us with the right people, and consistently following through on our asks. Beyond capital, they’ve helped us scale by offering perspective, supporting hiring efforts, and expanding our network of advisors and candidates.

Shruti Kapoor

Co-Founder & CEO, Wingman